Dubai Real Estate Snapshot: April 2024

In April 2024, Dubai’s real estate market continued to show robust growth with 11,600 transactions worth a whopping AED 32 Billion (that’s over 1 billion dirhams a day). This growth was led by villas for sale, which saw an increase of 2.4% since March of this year and a huge increase of 31.2% since the same time last year. Apartments saw a slight bump in prices of 1.6% since last year and a larger 21.3% since this time last year.

Housing Units Entering The Market

According to the Dubai Statistics Centre (DSC), Dubai’s population surged by over 100,000 in 2023, while around 40,000 new residential units handed over last year. Projections for 2024 indicate similar trends, with population growth expected to match last year’s figures and an estimated 35,000 to 50,000 new homes anticipated for handover but it is clear that there is still a shortfall in homes for current and new residents.

Market Dynamics, Off Plan vs Ready Properties

The total value of transactions for April 2024 was impressive, with villa valuations surpassing AED 2,000 per square foot for the first time in a decade. This indicates a robust demand for high-end properties and a willingness among buyers to invest in luxury real estate. Compared to the same period last year, the market has seen a significant uplift in both volume and value, showcasing the resilience and continued upward trajectory of Dubai’s real estate market.

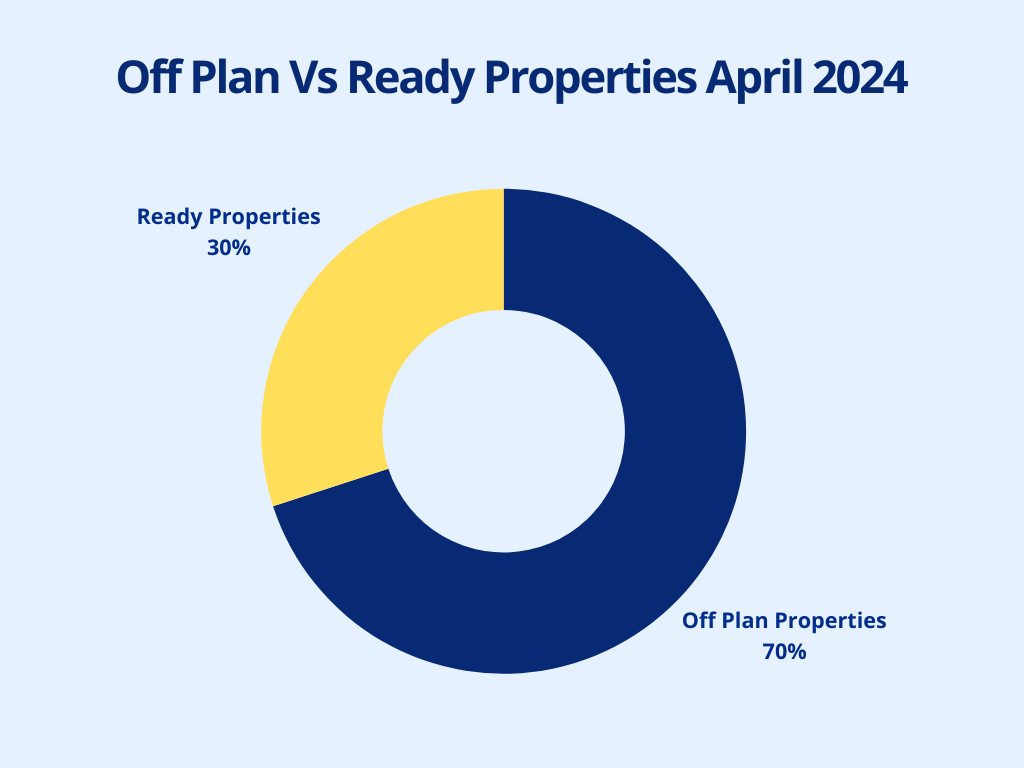

The market dynamics revealed a clear preference for off-plan properties, which recorded the highest volume and value of transactions. Off-plan transactions surged by 76.4% year-on-year, despite a 9.4% decline since March. This surge indicates strong investor confidence in future developments and the potential for capital growth. On the other hand, ready home transactions, while growing 9.5% year-on-year, experienced a 24.2% drop compared to March, making up just 30% of total sales for the month. This trend underscores a shift towards investment in new and upcoming projects, likely driven by attractive payment plans and the promise of modern amenities and designs.

| Off Plan Transactions | Ready Property Transactions |

| 7,387 | 3,166 |

The divergent trends between off-plan and ready properties highlight the evolving preferences of buyers and investors in Dubai. The significant rise in off-plan transactions suggests that investors are looking to capitalize on the long-term growth prospects of the city, particularly in the south and west of the city.

In contrast, the slight decline in ready home transactions may indicate a saturation in certain segments or a strategic shift towards newer, more innovative projects with cheaper price points and spread out payment plans. The increase in property values, particularly for villas, points to a growing demand for luxury and high-end properties, reflecting the overall economic growth and the increasing affluence of buyers coming into the region. Regional instabilities usually lead to upward trends in the Emirate, as can be seen in the total number of off plan sales in April.

The rise in apartment prices was also notable, with a 1.6% month-on-month increase. Significant annual price increases were observed in areas such as Discovery Gardens (33.4%) and The Greens (31.4%). These are not particularly affluent areas but do signify that baseline properties are starting to increase in value, which is a very good sign and signifies a demand for well-established neighborhoods, however dated they may be becoming.

Villa for sale in Dubai saw prices increased by 2.4% month-on-month, with annual growth in premium areas like Palm Jumeirah (40.1%) and Jumeirah Islands (39.5%). These areas continue to attract high-net-worth individuals and investors seeking luxury living and exclusive lifestyles.

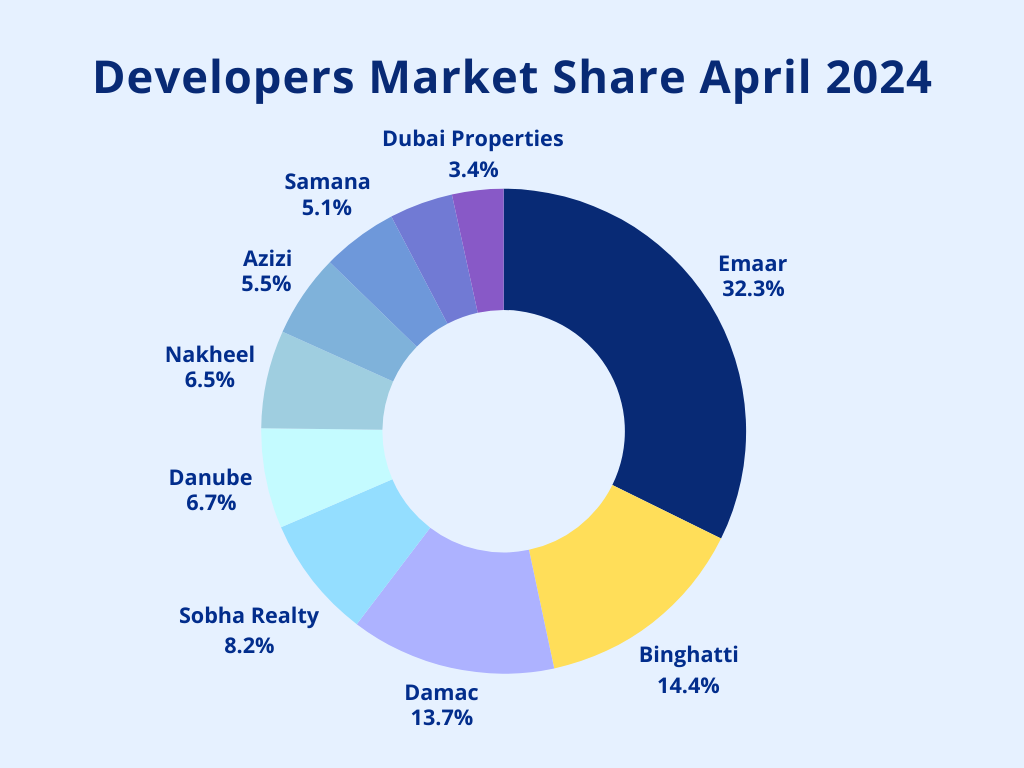

Top developers in April included Emaar (19.8% market share), Binghatti (8.8%), and Damac (8.4%). The leading locations for off-plan sales were Jumeirah Village Circle (16.9%) and Zabeel First (14.2%), while ready home sales were concentrated in Jumeirah Village Circle (8.7%) and Business Bay (7.3%).

Conclusion

The data underscores a thriving and competitive market, with significant opportunities for real estate investments in Dubai. The substantial growth in both villa and apartment sectors indicates strong investor confidence and a favorable investment climate. Globally, Dubai’s real estate market remains an attractive destination for high-value property investments, bolstered by its strategic location, economic stability, and continuous development initiatives.

Share this article on: